Student loan debt stories: âMoney for big life changesâ

For a lot of people, resuming student loan debt payments will mean their lives are turned upside down and inside out. In short, people are worried about their finances, future, family and more.

Understanding the weight of this debt, Reckon has asked readers to tell us what debt relief would mean for them and how paying back their loans would shake up their world. They appear weekly in the Broke & Bothered newsletter and regularly on our site.

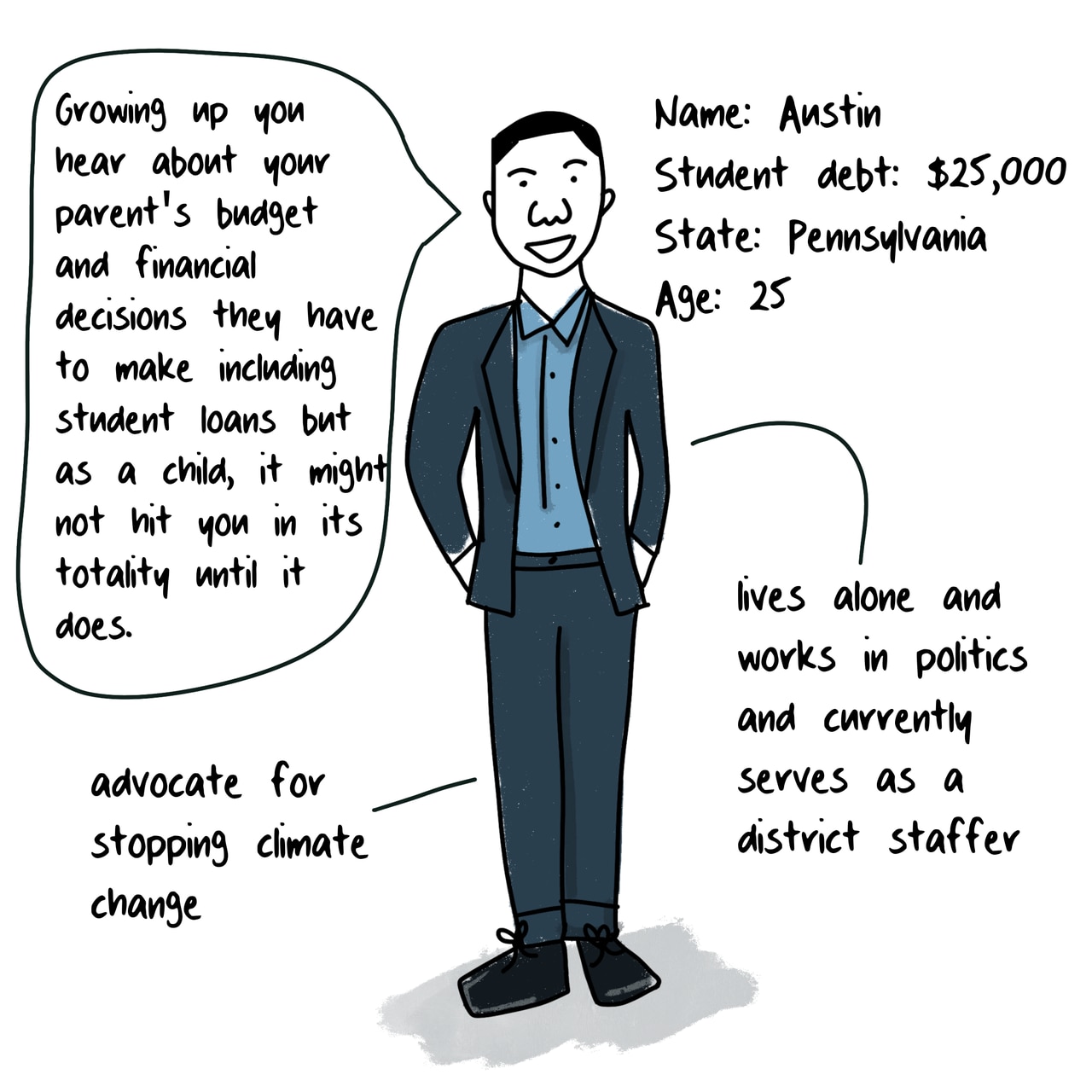

Austin J. is 25 years old, lives in Pennsylvania and has $25,000 in federal student loan debt.

The following has been edited for length and clarity.

Growing up you hear about your parent’s budget and the financial decisions they have to make, including student loans but, as a child, it might not hit you in its totality.

I have four parents in my life. While my mom and stepdad did not go [to] or finish college, my dad and stepmom are both college graduates with master’s degrees and a substantial amount of student loan debt that they’ve been paying on for decades.

In college, my dad and stepmom were able to help with my books, clothes, food and a few dollars every now and again, all while being in their late 40s and still paying off their own student loans. This is a systemic issue that has punished the past couple of generations and mine too for pursuing a higher education.

Austin J. is 25 years old, lives in Pennsylvania and has $25,000 in federal student loan debt.

What they say is true: it takes a village to raise a child. I was fortunate and privileged to have a mom and stepdad who were able to assist me in keeping my loans lower than otherwise.

Now that I’ve graduated and I’m working as a district staffer in Pennsylvania with $25,000 in student loan debt, I have had to make plans to contend with my own loans.

I recently found out that I qualify for only paying $20 a month under the Biden Administration’s new rates for repayment based on salary. I just keep thinking, ‘What if I didn’t qualify and made more than I currently do? Would my payments jump to $100 or $150?’

These financial factors restrict my options for living within my means to a degree, especially since I’m in the process of saving to go back to school and get a new(er) car. Money that could be going to these big life changes will now have to be sacrificed for my student loans, no matter how small.

–

Want to read more student loan debt stories like Austin’s? Click here to read real stories of people most impacted by the student loan debt crisis.